vermont state tax withholding

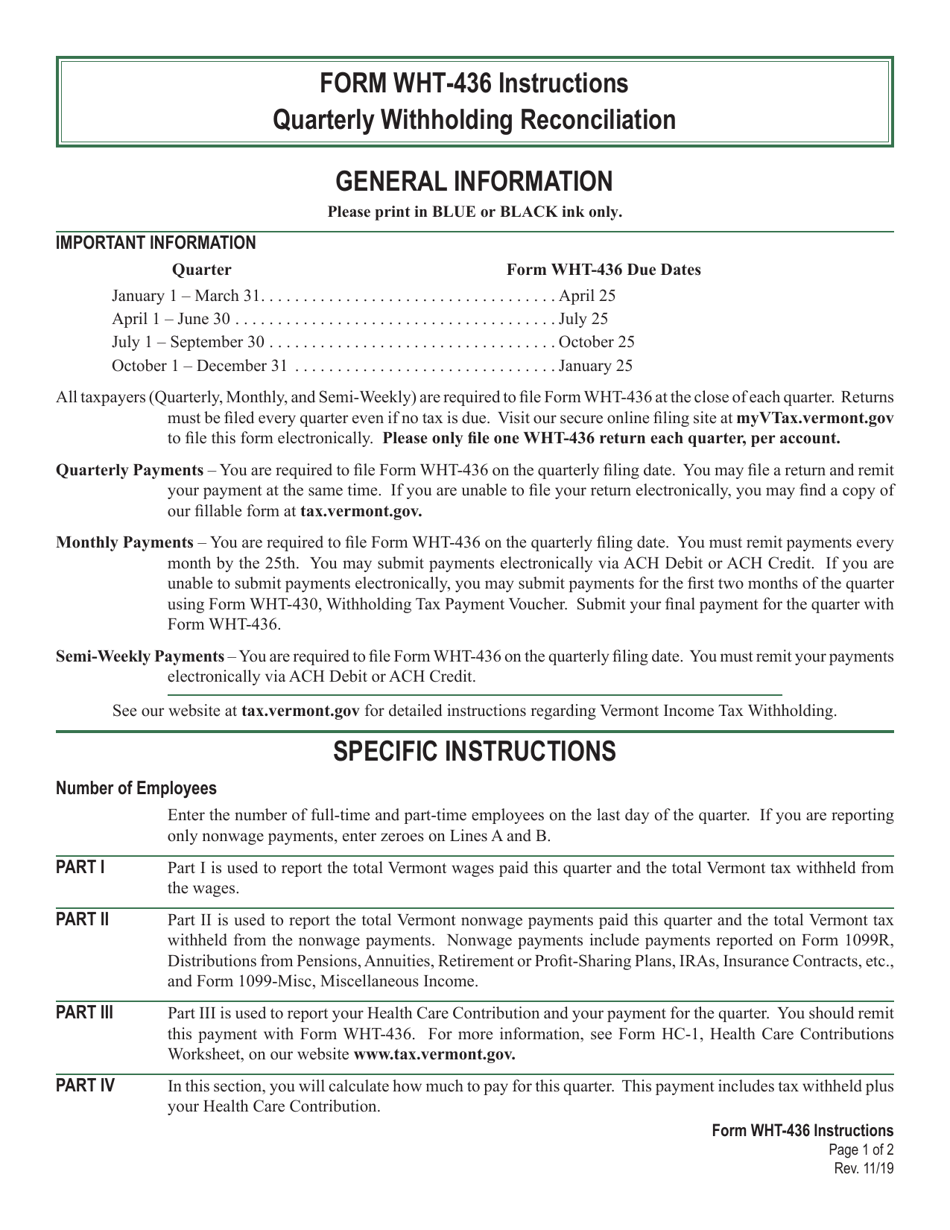

Tax Year 2020 Form WHT-436 Quarterly Withholding Reconciliation and HC-1 Health Care Contributions Worksheet 2021 Income Tax Withholding Instructions Tables and Charts - copy Tax Rates and Charts. The Single Head of Household and Married annual income tax withholding tables have changed.

The annual amount per allowance has changed from 4350 to 4400.

. If Federal exemptions were used and there are additional Federal withholdings proceed to step 8. Your Vermont withholding account number should start with WHT and either a 10 or a 11. The amount of the tax is 25 of the gross sale price eg with a contract sale price of 25000000 the withholding tax is 625000.

If Federal exemptions were used and there are additional Federal withholdings proceed to step 8. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. 7 rows Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding.

The income tax withholding for the State of Vermont includes the following changes. The income tax withholding for the State of Vermont includes the following changes. The annual amount per exemption has increased from 4250 to 4350.

The Vermont bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. You should receive your account number in 5-7 days. PA-1 Special Power of Attorney.

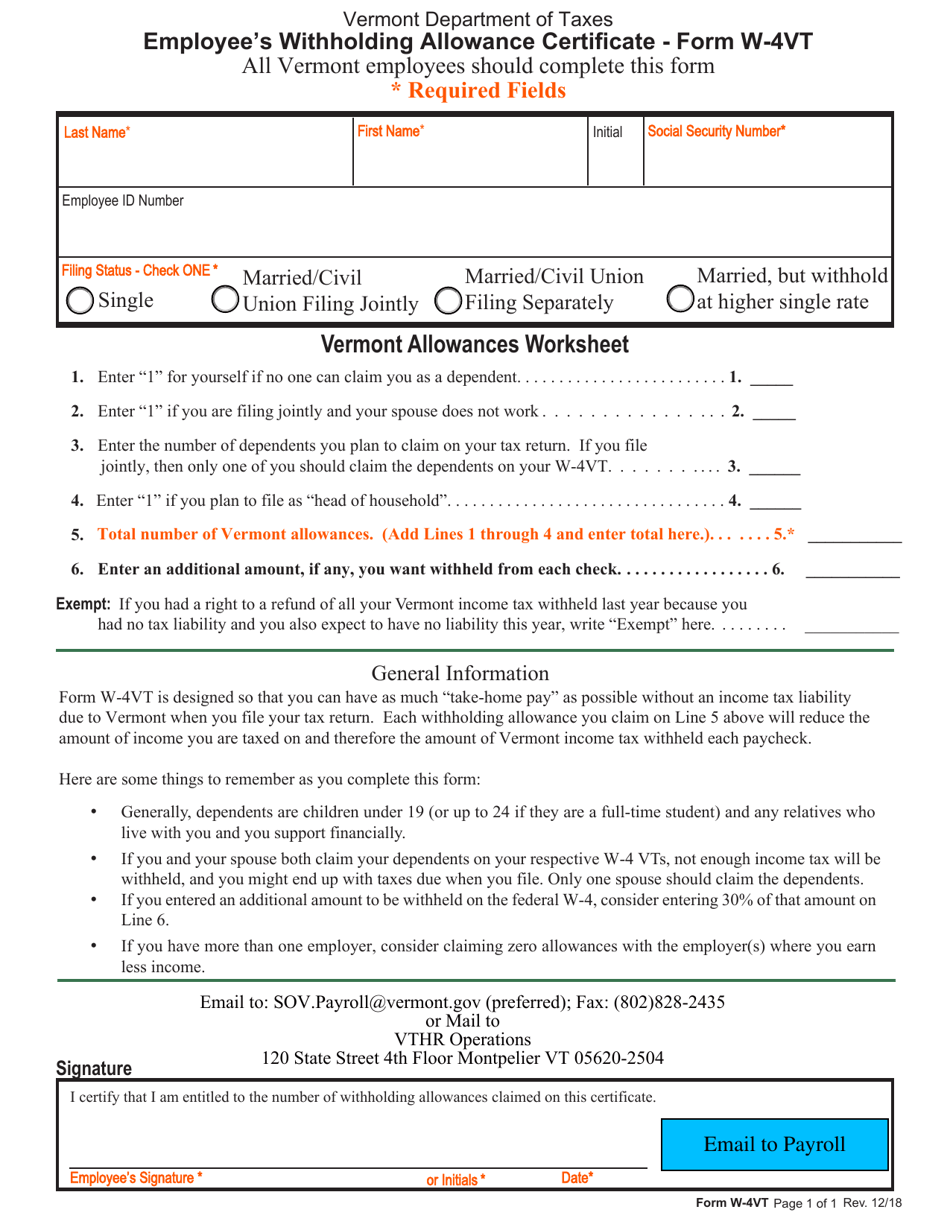

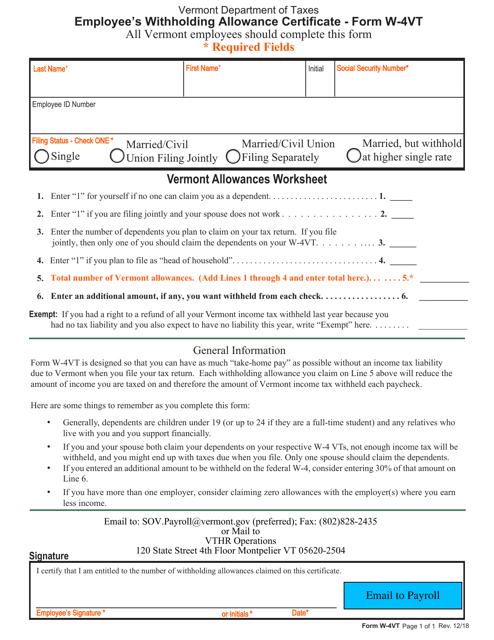

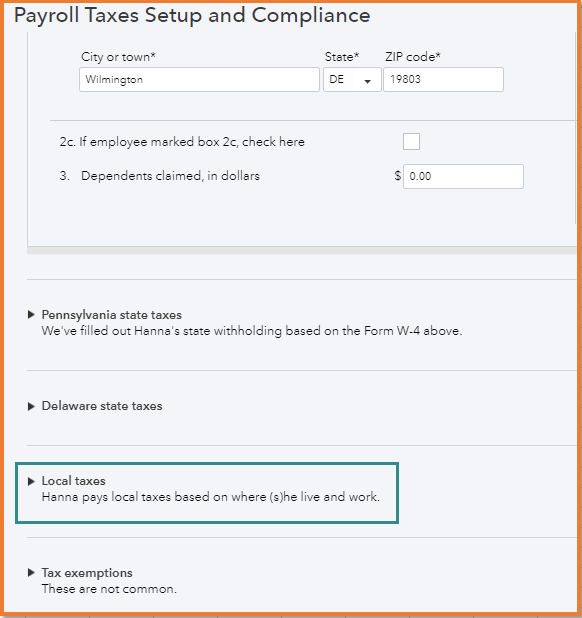

Once the employer has the information youve entered on forms W-4 and W-4VT the employer is able to calculate your withholding tax. With rare exceptions if your small business has employees working in the United States youll need a federal employer identification number EIN. Applicable state tax withholding for retirement plan distributions The information in this table is our application of state requirements as of June 30 2020.

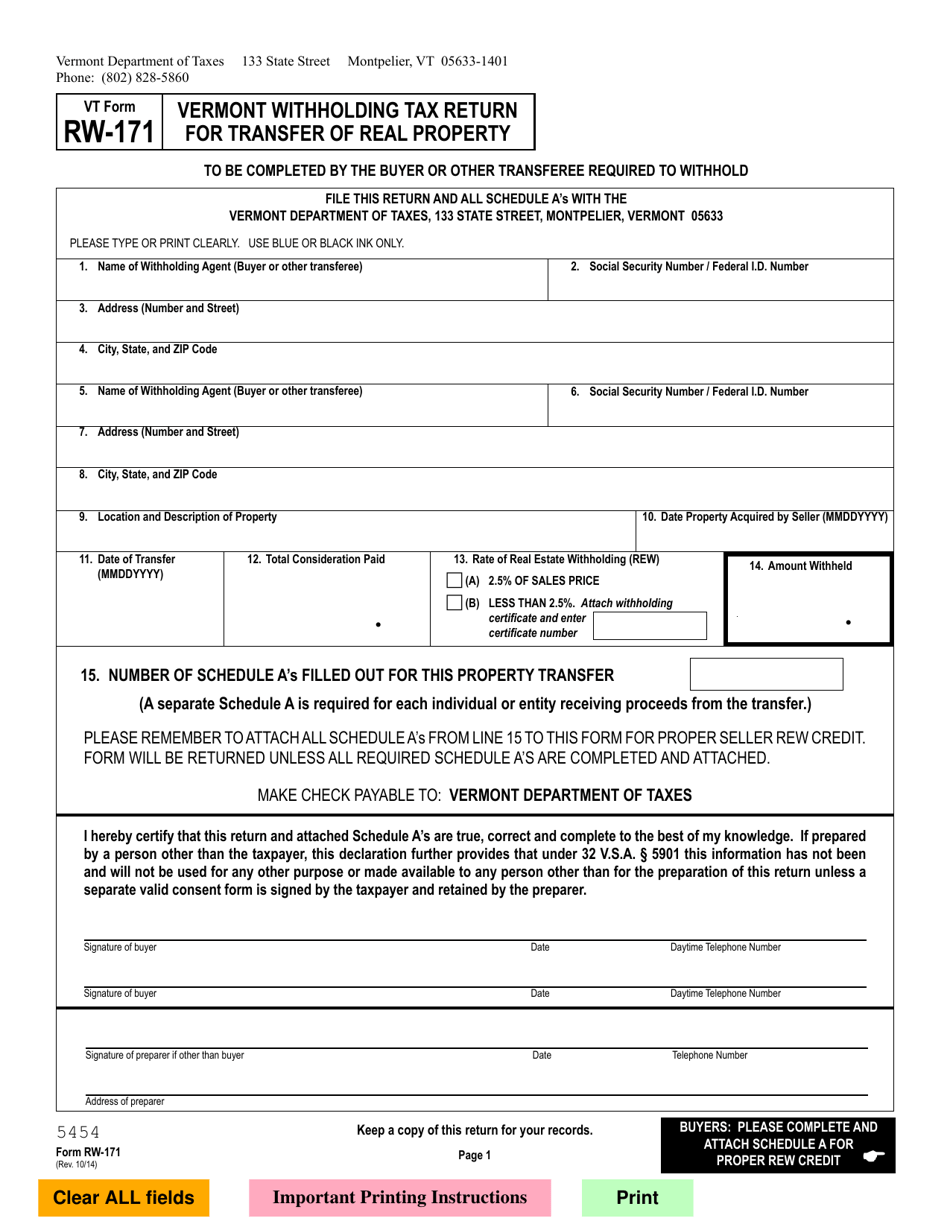

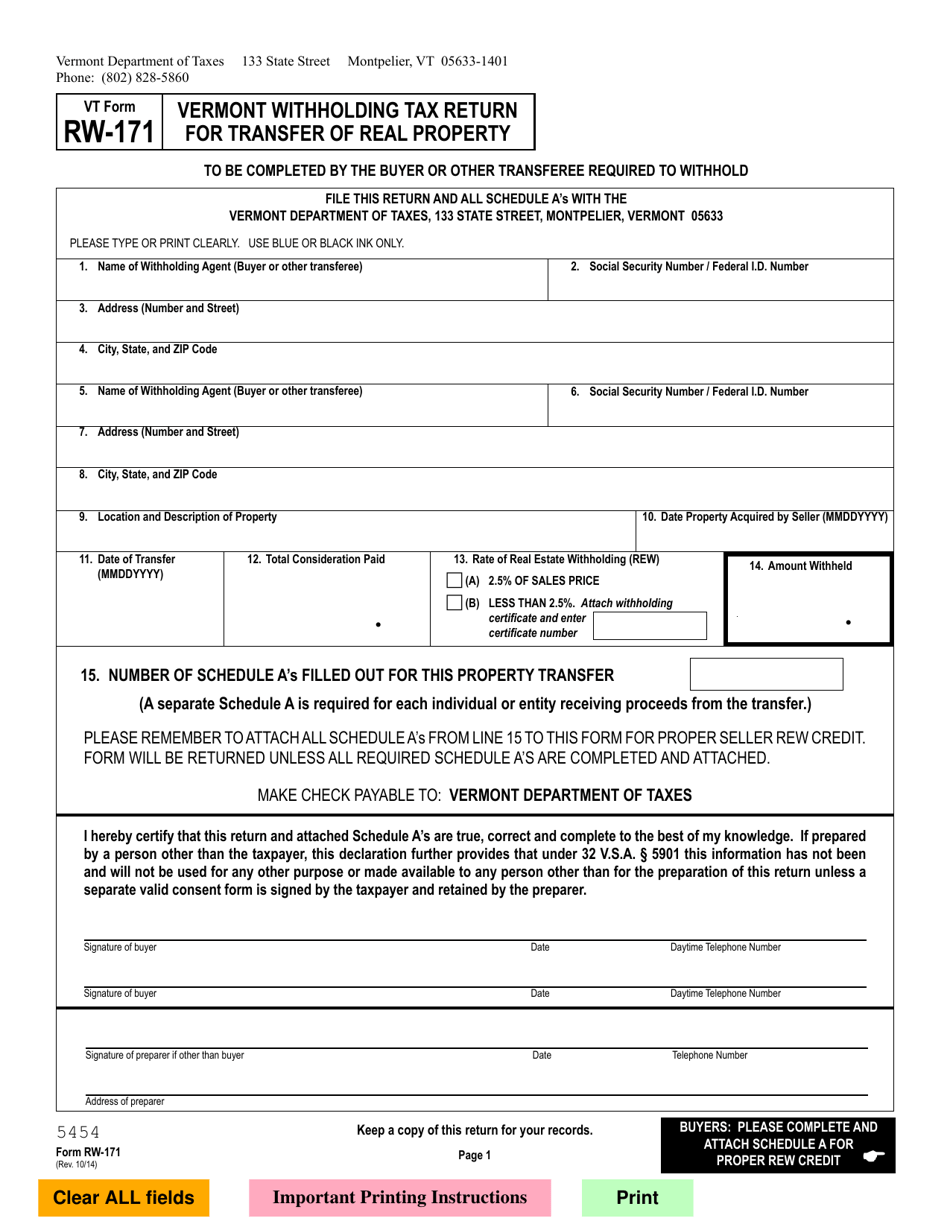

In Vermont sellers of real property who are not residents of the state are subject to a real estate withholding tax collected at the time of closing. Complete the remaining questionsfields. If you have any questions about the process call the agency directly at 802 828-6802 or send an email to taxbusinessvermontgov.

If additional Federal tax was withheld multiply the additional amount by 26 percent and add that to the result of step 7 to obtain the biweekly Vermont tax withholding. State government websites often end in gov or mil. Tax Formula Withholding Formula Effective Pay Period 06 2017.

Here are the basic rules on Vermont state income tax withholding for employees. Before sharing sensitive information make sure youre on a state government site. You should obtain your EIN as soon as possible and in any case before hiring your first employee.

Plan the correct withholding rate is 6 of the deferred payment. No action on the part of the employee or the personnel office is necessary. The gov means its official.

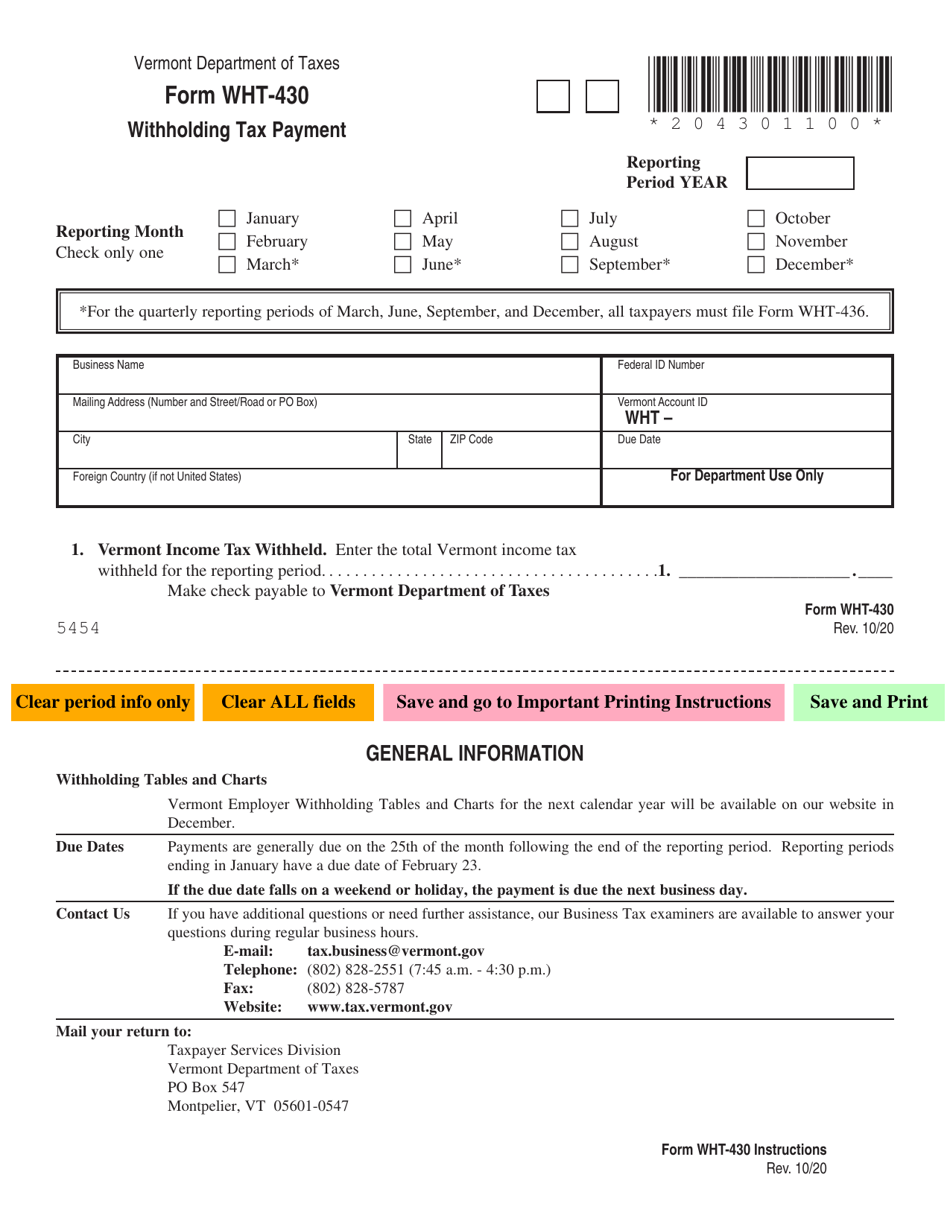

Apply the taxable income computed in step 5 to the following table to determine the annual Vermont tax withholding. Reporting and Remitting Vermont Income Tax Withheld If you pay wages or make payments to Vermont income. The Single and Married income tax withholdings will increase for the State of Vermont as a result of changes to the formula for tax year 2017.

Real Estate Withholding Overview When real estate is sold in Vermont state income tax is due on the gain from the sale whether the seller is a resident part-year resident or nonresident. State government websites often end in gov or mil. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding.

Although a state may allow more than one method to calculate state tax withholding Vanguard uses the method listed below. If the seller is a nonresident the buyer is required to withhold 25 of the sale price and remit it to the Vermont Department of Taxes. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding.

8 rows The income tax withholding for the State of Vermont includes the following changes. IN-111 Vermont Income Tax Return. No action on the part of the employee or the personnel office is necessary.

If Federal exemptions were used and additional Federal tax was withheld multiply the additional amount by 27 percent and add that to the result of. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding. If Federal exemptions were used and there are additional withholdings proceed to step 8.

When you receive your payeither by direct deposit or paper. The withholding is based on both the deferred payment and any income that may be derived from the deferred compensation. The Single or Head of Household and Married income tax withholding tables have changed.

To help employers calculate and withhold the right amount of tax the IRS and the Vermont Department of Taxes issues guides each year that include withholding charts and tables. States may change their requirements at any time. No action on the part of the employee or the personnel office is necessary.

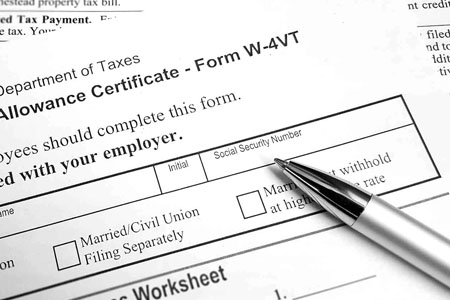

2017 and 2018 Income Tax Withholding Instructions Tables and Charts. W-4VT Employees Withholding Allowance Certificate. Before sharing sensitive information make sure youre on a state government site.

State W 4 Form Detailed Withholding Forms By State Chart

Vt Form W 4vt Download Fillable Pdf Or Fill Online Employee S Withholding Allowance Certificate Vermont Templateroller

Vt Form W 4vt Download Fillable Pdf Or Fill Online Employee S Withholding Allowance Certificate Vermont Templateroller

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Irs Form 945 How To Fill Out Irs Form 945 Gusto

Vt Form Wht 430 Download Fillable Pdf Or Fill Online Withholding Tax Payment Vermont Templateroller

I Am A Pa Employer And I Am Unableto Set Up Local

State W 4 Form Detailed Withholding Forms By State Chart

Individuals Department Of Taxes

Irs Installment Agreement Wheatfield In Mm Financial Consulting Inc Irs Payment Plan Business Plan Template Free How To Plan

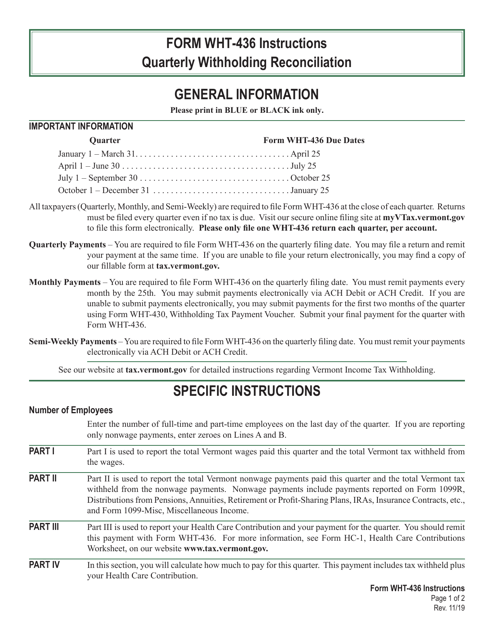

Download Instructions For Vt Form Wht 436 Quarterly Withholding Reconciliation And Health Care Contribution Pdf Templateroller

Vt Form Rw 171 Download Fillable Pdf Or Fill Online Vermont Withholding Tax Return For Transfer Of Real Property Vermont Templateroller

Download Instructions For Vt Form Wht 436 Quarterly Withholding Reconciliation And Health Care Contribution Pdf Templateroller